Customer Lifetime Value (CLV), also known as CLTV or LTV, is a crucial metric that measures the total revenue a business can expect to earn from a customer over the entire duration of their relationship. It provides insights into customer profitability, helping businesses make informed decisions on customer acquisition, retention, and service strategies.

Components of CLV

- Customer Revenue

- Total income generated by a customer through purchases over time.

- Customer Retention Period

- The duration for which a customer remains actively engaged with the business.

- Customer Acquisition and Servicing Costs

- The expenses incurred in acquiring and serving a customer, including marketing, sales, and support costs.

- Profit Margin

- The portion of revenue remaining after deducting costs associated with providing the product or service.

Significance of CLV

1. Financial Insights

- Helps determine how much a company can afford to spend on acquiring and retaining customers.

- Identifies the most profitable customer segments, guiding resource allocation.

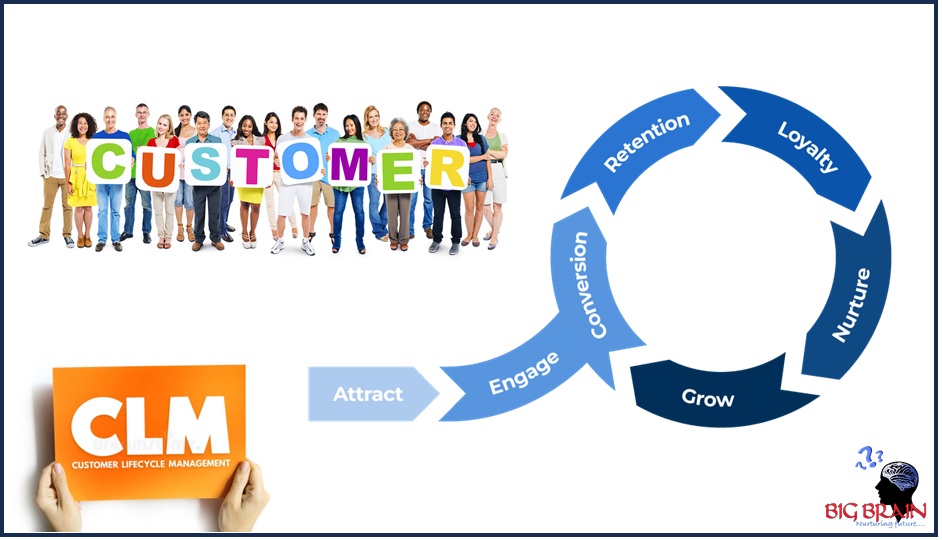

2. Customer Retention

- Encourages businesses to focus on building long-term relationships with customers rather than one-time transactions.

- Highlights the value of improving customer experience to enhance loyalty and reduce churn.

3. Strategic Decision-Making

- Aids in designing targeted marketing campaigns aimed at high-value customers.

- Supports pricing strategies and product development based on customer preferences and profitability.

4. Profitability Maximization

- By understanding CLV, businesses can prioritize customers with the highest lifetime value, optimizing overall profitability.

Calculating CLV

There are various approaches to calculating CLV, ranging from simple to complex, depending on the business model and available data.

1. Basic Formula

CLV=Average Purchase Value×Purchase Frequency×Customer Lifespan\text{CLV} = \text{Average Purchase Value} \times \text{Purchase Frequency} \times \text{Customer Lifespan}

2. Detailed Formula Including Costs

CLV=(Revenue Per Customer−Costs to Serve)×Customer Lifespan\text{CLV} = (\text{Revenue Per Customer} – \text{Costs to Serve}) \times \text{Customer Lifespan}

3. Predictive CLV

For businesses with historical data, predictive models use variables like customer behavior, purchase history, and engagement patterns to estimate future value.

Factors Influencing CLV

- Customer Retention Rate

- Higher retention rates increase the average customer lifespan, directly impacting CLV.

- Customer Spending

- Frequent purchases and higher transaction values contribute to greater CLV.

- Customer Acquisition Costs (CAC)

- Lower acquisition costs result in higher profitability per customer.

- Profit Margins

- Products or services with higher profit margins enhance the overall lifetime value of customers.

- Customer Engagement

- Personalized experiences, loyalty programs, and effective communication encourage repeat business and loyalty.

Strategies to Increase CLV

1. Improve Customer Experience

- Deliver exceptional service at all touchpoints to build trust and loyalty.

- Ensure seamless interactions across multiple channels.

2. Personalization

- Use data analytics to understand customer preferences and tailor products, services, and communication to individual needs.

3. Enhance Customer Retention

- Implement loyalty programs and rewards to encourage repeat purchases.

- Address customer complaints promptly to prevent churn.

4. Cross-Selling and Upselling

- Offer complementary products (cross-selling) or upgraded versions of existing products (upselling) to increase purchase value.

5. Regular Engagement

- Keep customers engaged through newsletters, promotions, and personalized recommendations.

6. Reduce Churn

- Identify reasons for customer attrition and address them proactively to retain valuable customers.

7. Optimize Pricing Strategies

- Introduce subscription models, bundles, or tiered pricing to incentivize long-term customer relationships.

Applications of CLV

- Marketing Budget Allocation

- Helps determine how much to spend on acquiring customers from different segments.

- Customer Segmentation

- Identifies high-value customers, allowing businesses to focus on retention and growth strategies for this group.

- Performance Tracking

- Tracks the effectiveness of customer retention strategies over time.

- Business Valuation

- Investors and stakeholders often consider CLV when assessing the long-term profitability of a business.

- Product Development

- Guides innovations based on the preferences and behaviors of the most profitable customer segments.

Challenges in Measuring CLV

- Data Accuracy

- Reliable CLV calculations require accurate data on customer behavior, spending, and retention.

- Changing Customer Behavior

- Predicting future customer actions is inherently uncertain due to market dynamics and individual preferences.

- Complexity in Multi-Channel Businesses

- Tracking customer interactions across various channels can complicate the calculation of CLV.

- Accounting for Costs

- Differentiating between fixed and variable costs for customer servicing can be challenging.

CLV in Different Business Models

1. E-Commerce

- Focuses on repeat purchases, average order value, and marketing spend efficiency.

2. Subscription-Based Services

- Emphasizes retaining subscribers over a longer period to maximize CLV.

3. Retail

- Combines in-store and online purchase data to analyze customer spending and retention patterns.

4. SaaS (Software as a Service)

- Relies heavily on recurring revenue models and churn minimization to increase CLV.

CLV vs Other Metrics

CLV vs. Customer Acquisition Cost (CAC)

- CLV measures the revenue potential of a customer, while CAC measures the cost of acquiring that customer.

- A business’s profitability often hinges on maintaining a healthy CLV-to-CAC ratio, typically 3:1 or higher.

CLV vs. Average Revenue Per User (ARPU)

- ARPU reflects the revenue generated per user over a specific period, whereas CLV accounts for the entire duration of the relationship.

Conclusion

Customer Lifetime Value is more than just a metric; it is a comprehensive framework for understanding the long-term profitability of customer relationships. By focusing on increasing CLV, businesses can drive sustainable growth, foster loyalty, and maintain a competitive edge in the market. In a customer-driven economy, effectively leveraging CLV insights ensures that both customers and businesses derive maximum value from their interactions.